The Great Inflation Lie

Imperial Overextension Part 2: The Rot at the Core

I know, I know. I said previously that I’d make posts shorter. But inflation is such a complex and pernicious subject that it’s very difficult to adequately discuss it without going into detail. So bear with me for the 10-15 minutes it’ll take to read this piece and think about how badly we’ve been misled.

After all, if there’s one thing that’s as ubiquitous as inflation right now, it’s lies about inflation. From the “transitory inflation” claims of 2021 to any notion that inflation has been “tamed,” we’re all being snowed. Overall inflation is “only” around 4% now officially in the US, though really it’s significantly higher than that.

But that isn’t the Great Inflation Lie that this article is named in honor of.

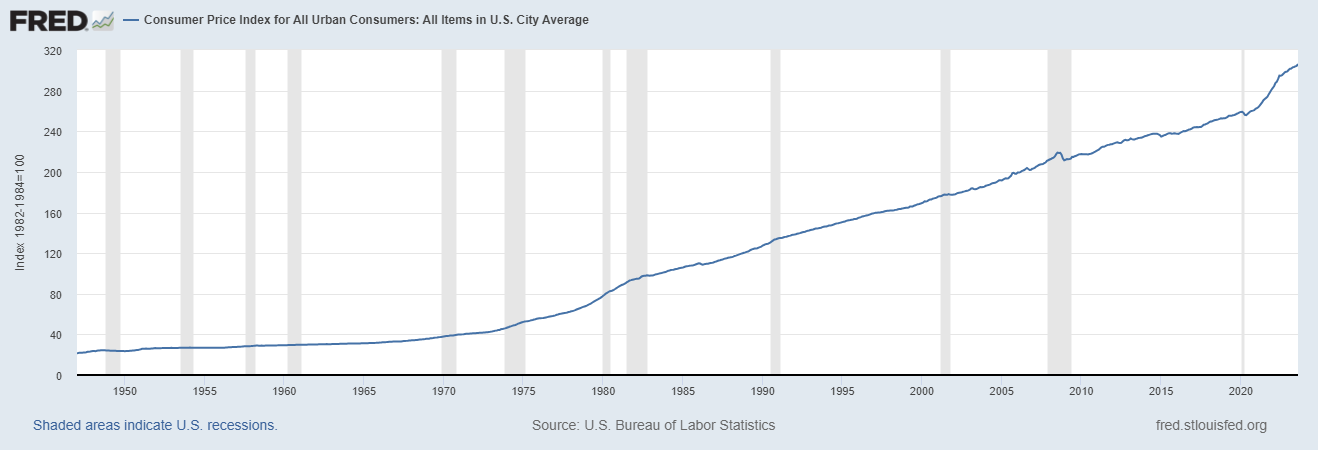

No, that lie is this compound belief: Our inflation targets are healthy, and inflation has only occasionally been a problem. In reality, inflation has been eroding the value of the dollar for 110 years, and the entirety of the last 80 years has been inflationary — with two (2) very brief periods of deflation to break it up. In fact, unless you’re very old, you’ve lived in an inflationary environment your whole life. Your effective funds have been robbed from you silently, slowly, with little discussion for many years and certainly without your consent.

Consider these two truths:

The inflation target for the Federal Reserve and many other Central Banks around the world is 2% and,

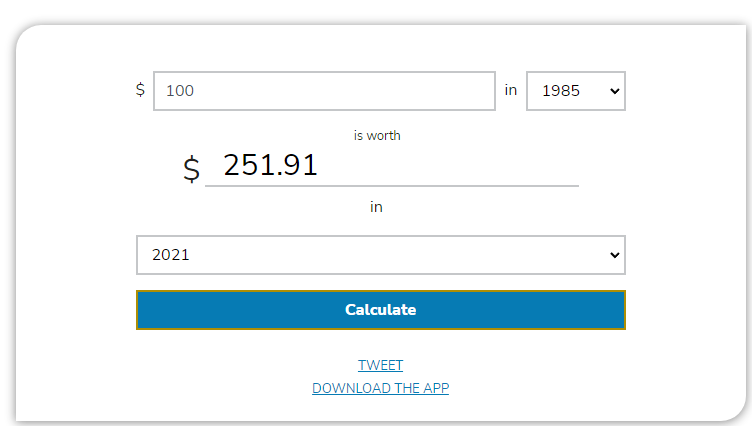

Going by the rule of 72, at 2% inflation, money’s value halves every 36 years.

Simply put, if you had stuffed $100 under the mattress in 1985, it would have been worth ~$50 in 2021 even at the 2% inflation target deemed to be “healthy.” Life experience, like simple vending machine economics, would bear this idea out. But inflation has been far above 2% recently, so you and I are losing money faster than ever. Like gangrene, if it spreads unchecked, inflation will eventually kill its host. History is littered with such examples. If readers are interested, that could be a fun article to write.

For reference, I’ll be discussing inflation in the US in this article, but the same principles apply everywhere — with the caveat that the world’s reserve currency is less vulnerable to losing value internationally. Internally, the mechanics are the same, though. If any readers are from especially inflation-hit countries like Turkey, Lebanon, Zimbabwe, Venezuela, or others, I’d love to hear about your experience.

Whence the Target?

You may be wondering, “Why 2%?” That’s a fair question. Here is a “full” (tiny) explanation from the Federal Reserve — hilariously, from 2020 — from which I will draw one poignant excerpt.

The Federal Open Market Committee (FOMC) judges that inflation of 2 percent over the longer run, as measured by the annual change in the price index for personal consumption expenditures, is most consistent with the Federal Reserve’s mandate for maximum employment and price stability. When households and businesses can reasonably expect inflation to remain low and stable, they are able to make sound decisions regarding saving, borrowing, and investment, which contributes to a well-functioning economy.

In short, they go for 2% because that’s what people expect. But people expect it because that's what the Fed sets as its target. It’s circular logic. Besides that, though, there are two glaring problems with their statement:

1. Prices have been nowhere near stable, and especially not since 1971. I probably don’t need to tell you that wages have not risen as quickly as costs for most people, but hey, take a little informal poll to see what people around you say.

2. It also goes against the Fed’s inflation expectation data drawn from the University of Michigan, which is consistently and significantly higher than 2%, but whatever.

There’s been discussion of aiming for a 3% target inflation rate instead of 2%, mostly because there’s no way to get back to 2% without immense, politically difficult pain. Even if that 3% target is hit, money will lose half its value in 24 years instead of 36. That means you get to watch currency lose half its value three times in a lifetime instead of just twice — and that’s the optimistic scenario. Hooray!

There are some simultaneously fun and depressing tools to play with to see just how much inflation has hit. The Bureau of Labor Statistics and the Federal Reserve Bank of Minneapolis both provide handy little consumer price index (CPI) inflation tools that I recommend playing with. The CPI is by no means a perfect metric, but it’s good enough for government work (heh). So what would our $100 stuffed under the mattress really look like 36 years later in 2021?

That’s a solid ~60% decrease. Ouch. And that’s before the nasty inflation from the last two years really kicked in. So halving every 36 years? It’s been faster than that, and given the inflation of the last two years, way faster. For reference, at 12% inflation, money would lose half its value in only 6 years.

And that’s just the abstract notion: There are of course specific items that have skyrocketed in price far above nominal inflation rates, like housing, education, fuel, and all sorts of consumables. What’s been the biggest price change you’ve seen? I’m curious to hear.

Unnatural Undertakings

Not everyone agrees that inflation is always awful, of course. Arguments in favor of inflation state that the money supply has to grow to accommodate a growing population, and that modest inflation encourages people to spend and invest. Deflation, on the other hand, has the opposite effect: People hold onto their money and hesitate to invest, because money becomes worth more over time while assets lose value. These are both fair points when taken at their most basic levels.

But to argue that 2% inflation is “healthy” is absurd. Money’s value halving twice in an average lifetime erodes trust in a nation, its economy, and in the validity of free markets. How can you argue a market is free when money is losing value all the time? Inflation is not an accident — it’s a result of intentional policy. It’s a silent tax that’s never voted upon. The phrase “taxation without representation” very much applies.

A major problem is that inflation is poorly understood. If inflation is flat on a chart, it doesn’t look like it’s growing — but it is, as it compounds. Hell, in July 2022, President Biden tried to claim that the US experienced zero percent inflation that month. Clearly he either doesn’t know the difference between inflation growth and actual inflation or was (gasp) lying, but that’s no shocker.

What’s also poorly understood is deflation. We don’t even know what a deflationary period looks like in the modern world. Or, maybe people “know” academically, but not practically. In the Western world, deflation is currently an unknown concept outside of university theories. We only experienced a tiny deflation blip in 2008-09 in the CPI that accompanied the near-death experience of the global financial system.

Really, deflation should be the natural trend given the technological advances of the last few decades. Technology, especially automation, makes a huge number of consumer goods cheaper to make than ever before. This is well explained in Jeff Booth’s excellent book The Price of Tomorrow, in which he convincingly argues that inflation is an unnatural contrivance that flies in the face of reality. It’s solely the creation of Central Bankers and their cohorts in major financial institutions, and is encouraged by governments. And while deflation is an unstoppable force that may indeed lead to wide-scale and lasting unemployment, our current inflationary system is built on a completely unsustainable mountain of debt.

Inflation was a major topic in the 1970’s and early 1980’s, and is again now. But it has continued steadily for the last 80 years, and is only accelerating. It is not going away. And it represents our Central Banks’ complete disregard for the social contract that currency is meant to represent. By “social contract” here, I mean we all agree on what certain things are worth, even in a fiat currency environment. But like a castle built on shifting sands, its instability leads inexorably to wealth inequality, mistrust, confusion, and eventually collapse.

This abrogation of our social contract represents the zealous overexpansion of an empire I alluded to in a previous post. It also is a trend that has carried on for decades. And it will ruin us if we allow it to continue.

But how on Earth can it be stopped?

Short answer: It can’t as long as governments rely on ever-larger piles of debt to fund their expenses.

Inflation: A Debtor’s Best Friend

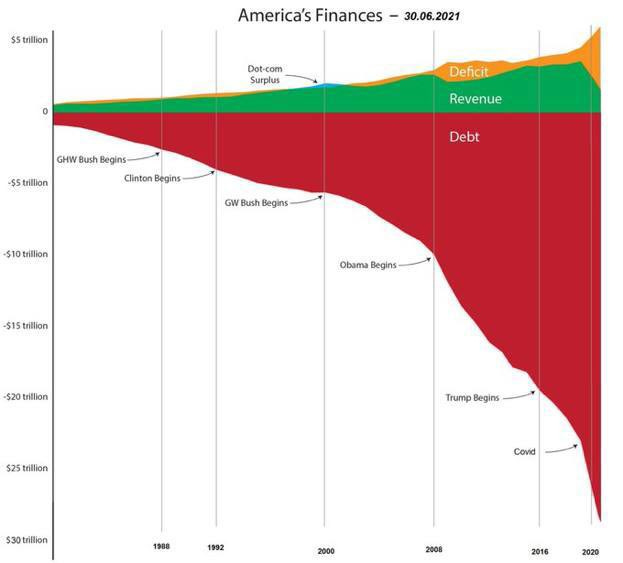

Inflation is wonderful for those in debt. Governments, above all, love inflation because it allows them to pay off debt at lower values. And for a country that just added $10 trillion in debt in the last 3 years, you’d better believe the US government is infatuated with inflation.

Even if you hold a mortgage and your salary has gone up, inflation can represent a win for you. The opposite can be seen in the struggles of indebted farmers in the latter decades of the 1800’s in the US. In a hard money environment that was often deflationary, mortgages could be worth triple their original value after 20 years. That’s painful. It contributed significantly to the rise of railroad industries and other trusts that bought up land on the cheap from farmers who could no longer afford their debts.

So what’s the problem? Everyone wins but the lender if there’s inflation, right?

If you chuckled, you’re on to it. Today’s money is as far from real as it gets. It’s the easiest time in history to inflate currency — at least the Romans had to physically debase their coinage, and the US prior to 1971 had to at least try to pay attention to gold’s value.

So who wins? Primary dealers (major financial institutions) get the benefits the most. If a bank wants to sell mortgage-backed bonds to the Federal Reserve, the Reserve only needs to make a few keystrokes and, presto change-o, there is more money. Odorless, tasteless, non-physical money, but money nonetheless that can be thrown into ever-expanding bubbles.

Of course it doesn’t go to you, silly pleb. It goes to the bank. Who do you think you are? Take your little stimulus and be quiet.

That brings us back to governments. Modern Monetary Theory (MMT) suggests that a country that controls the world’s reserve currency (i.e. the USA) can never go into default as it can issue unlimited currency and export a significant part of its inflation. That’s been happening for a long time. There’s a lot of crisp, new $100 bills in Cambodia, I can promise you.

You can ignore reality, but you can’t ignore the consequences of ignoring reality. Imagine a friend eats 2 dozen donuts, smokes 3 packs of cigarettes, and drinks a gallon of whiskey a day and says it hasn’t killed them yet, so they’re invulnerable. You know eventually it will catch up with them. And such a metaphor is accurate for the gluttonous behavior of the US government in recent decades. The chart below is from 2021, but its clever design shows a descent into debt that can’t be fixed.

The larger the government, the more it spends. The more it spends, the more the debt grows. And the more the debt grows, the greater the pressure for inflation. So, let’s tie a nice ribbon on this series of assertions: As a government grows, so does inflation.

For now, however, both the Federal Reserve and the Federal Government are stuck. Interest rates are rising at the fastest rate in 40 years, making debt repayments more expensive than ever. For the first time, US interest payments on the federal debt will eclipse military spending. Interest payments have essentially doubled since 2020. Once again…ouch.

There’s more, though: This trend is nowhere near done. Nearly $7 trillion in Federal debt is maturing in 2023. Having been borrowed at near-zero interest rates, the debt will be many times more expensive to pay. This really looks like the start of a death spiral. If you see a way out of it, let me know, since there’s probably a Nobel Prize in it for you.

Realistically, the US is faced with two choices: inflate or default. They will inflate. I’m not predicting the death of the dollar, since it’s still strong internationally. But I am quite comfortable in saying that this path leads to national financial ruin. The only question is when, which makes for some serious suspense. I call this the Alfred Hitchcock Theory of Debt. Check out the article linked in the previous sentence for a fun read.

But hey, for some perspective, this has all happened before. Nothing is new under the sun. I have to stop here before I start writing about inflation in Rome and go down a rabbit hole.

For parting thoughts, here are two mantras:

End the Fed.

The Ghislaine Maxwell client list must be released.

May the wind be ever at your back.

The talking heads at Bloomberg are losing their shit over the possibility of "wage inflation." God forbid the plebs make any gains at all. Of course we know that any wage increases will be outstripped by inflation in food, energy, and housing. Even someone who owns their house free and clear will pay more in insurance and taxes and probably things like sewer, water, and trash service.

"Even if you hold a mortgage and your salary has gone up, inflation can represent a win for you." While that's true I've never seen anyone really come out ahead once all the other increases are considered. The boom/bust and inflation/deflation cycle only seems to benefit those closest to the source of money and power.

I'm pretty sure inflation is the plan. It's not feasible to end things like social security. And considering the goobermint forced everyone to pay in for their entire working life, I'm not on board with the idea that getting back what you've been promised is "selfish." So inflation is the perfect solution to fleece the taxpayers while still shelling out billions to the most corrupt government in Europe and being the largest employer in the world. If the inflation rate is sufficiently manipulated, the COLA can be far below real inflation. Over time someone's monthly SS payment will be enough to pay the electric bill. Problem solved!